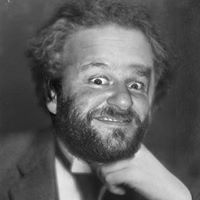

Lee W Grice

age ~60

from Auburn, AL

- Also known as:

-

- Lee Paige Grice

- Lee W Girce

- Phone and address:

-

1149 Knollwood Ct, Auburn, AL 36830

770 468-2016

Lee Grice Phones & Addresses

- 1149 Knollwood Ct, Auburn, AL 36830 • 770 468-2016

- Jasper, GA

- Suwanee, GA

- 1430 Edenham Ln, Cumming, GA 30041 • 770 886-9590

- Atlanta, GA

- Hartwell, GA

- 1430 Edenham Ln, Cumming, GA 30041 • 770 468-2016

Work

-

Position:Administration/Managerial

Education

-

Degree:Associate degree or higher

Emails

Name / Title

Company / Classification

Phones & Addresses

Manager

Equifax Inc

Credit Reporting Services

Credit Reporting Services

1505 Windward Concourse, Alpharetta, GA 30005

404 885-8000

404 885-8000

All In One Party Shop LLC

Biotechnology · Moonwalk Rentals and Party Supplies

Biotechnology · Moonwalk Rentals and Party Supplies

1430 Edenham Ln, Cumming, GA 30041

404 918-4537

404 918-4537

Resumes

Enterprise Solution Enabler

view sourceLocation:

1550 Vms Iqnavigator St northwest, Atlanta, GA

Industry:

Information Services

Work:

Equifax

Enterprise Solution Enabler - Key Client Program

Equifax Jun 1, 2004 - Jun 2013

Product Manager

Equifax Oct 2002 - Jun 2004

Assistant Vice President - Technology

Equifax Jan 1999 - Oct 2002

Assistant Vice President - Internet Business Development

Equifax Jan 1997 - Jan 1999

Manager - Integrated Development and Support Environments

Enterprise Solution Enabler - Key Client Program

Equifax Jun 1, 2004 - Jun 2013

Product Manager

Equifax Oct 2002 - Jun 2004

Assistant Vice President - Technology

Equifax Jan 1999 - Oct 2002

Assistant Vice President - Internet Business Development

Equifax Jan 1997 - Jan 1999

Manager - Integrated Development and Support Environments

Education:

Auburn University 1982 - 1987

Skills:

Product Management

Project Management

Pre Sales

Enterprise Software

Business Analysis

Marketing

Product Development

Analytics

Management

Vendor Management

Business Intelligence

Sdlc

Sales

Software Project Management

Strategic Partnerships

Team Building

Process Improvement

Business Process Improvement

Crm

Saas

Business Process Management

Human Resources

Financial Services

Cross Functional Team Leadership

Program Management

Strategy

Requirements Analysis

It Strategy

Product Marketing

Solution Selling

Software Development

Segmentation

Data Warehousing

Sql

Integration

Project Management

Pre Sales

Enterprise Software

Business Analysis

Marketing

Product Development

Analytics

Management

Vendor Management

Business Intelligence

Sdlc

Sales

Software Project Management

Strategic Partnerships

Team Building

Process Improvement

Business Process Improvement

Crm

Saas

Business Process Management

Human Resources

Financial Services

Cross Functional Team Leadership

Program Management

Strategy

Requirements Analysis

It Strategy

Product Marketing

Solution Selling

Software Development

Segmentation

Data Warehousing

Sql

Integration

Lee Grice

view source

Lee Grice

view source

Lee Grice

view sourceUs Patents

-

Application Processing And Decision Systems And Processes

view source -

US Patent:8108301, Jan 31, 2012

-

Filed:Oct 24, 2008

-

Appl. No.:12/257442

-

Inventors:Sandeep Gupta - Alpharetta GA, US

Christian Hall - Canton GA, US

James Reid - Alpharetta GA, US

Shen Lu - Duluth GA, US

Dennis Horton - Buford GA, US

Lee Grice - Cumming GA, US

Thresa Dixon - Canton GA, US

Scott Garten - Canton GA, US

Sudhakar Reddy - Suwanee GA, US -

Assignee:Equifax, Inc. - Atlanta GA

-

International Classification:G06Q 40/00

-

US Classification:705 38, 705 35, 705 39

-

Abstract:The present invention relates to application processing and decisioning systems and processes. One embodiment of the invention includes a method for automating decisioning for a credit request associated with an applicant. The method includes providing a user computer interface adapted to receive information associated with an applicant, and further adapted to display and receive information associated with at least one decision rule. The method also includes receiving information associated with an applicant through the user computer interface; receiving information associated with the applicant from at least one data source; and receiving a selection of information associated with a plurality of decision rules through the user computer interface. Furthermore, the method includes receiving a selection of rule flow information associated with the plurality of decision rules through the user computer interface; generating a plurality of decision rules based at least in part on the information associated with the applicant, based at least in part on the information associated with the applicant from at least one data source, and based at least in part on the selection of information associated with a plurality of decision rules, wherein an outcome associated with the at least one decision rule can be obtained; and based in part on at least the rule flow information, displaying at least a portion of the plurality of decision rules through the user computer interface.

-

Application Processing And Decision Systems And Processes

view source -

US Patent:20070022027, Jan 25, 2007

-

Filed:Aug 27, 2004

-

Appl. No.:10/546931

-

Inventors:Sandeep Gupta - Alpharetta GA, US

Christian Hall - Canton GA, US

James Reid - Alpharetta GA, US

Shen Lu - Dulruth GA, US

Dennis Horton - Buford GA, US

Lee Grice - Cumming GA, US

Thresa Dixon - Canton GA, US

Scott Garten - Canton GA, US

Sudhakar Reddy - Surwanee GA, US -

International Classification:G06Q 40/00

G06F 7/00

G06F 17/00 -

US Classification:705035000, 707100000

-

Abstract:The present invention relates to application processing and decisioning systems and processes. One embodiment of the invention includes a method for automating decisioning for a credit request associated with an applicant. The method includes providing a user computer interface adapted to receive information associated with an applicant, and further adapted to display and receive information associated with at least one decision rule. The method also includes receiving information associated with an applicant through the user computer interface; receiving information associated with the applicant from at least one data source; and receiving a selection of information associated with a plurality of decision rules through the user computer interface. Furthermore the method includes receiving a selection of rule flow information associated with the plurality of decision rules through the user computer interface; generating a plurality of decision rules based at least in part on the information associated with the applicant, based at least in part on the information associated with the applicant from at least one data source, and based at least in part on the selection of information associated with a plurality of decision rules, wherein an outcome associated with the at least one decision rule can be obtained; and based in part on at least the rule flow information, displaying at least a portion of the plurality of decision rules through the user computer interface.

-

Application Processing And Decision Systems And Processes

view source -

US Patent:20070179827, Aug 2, 2007

-

Filed:Aug 27, 2004

-

Appl. No.:10/928782

-

Inventors:Sandeep Gupta - Alpharetta GA, US

Christian Hall - Canton GA, US

James Reid - Cumming GA, US

Shen Lu - Duluth GA, US

Dennis Horton - Buford GA, US

Lee Grice - Cumming GA, US

Thresa Dixon - Canton GA, US

Scott Garten - Canton GA, US

Sudhakar Reddy - Alpharetta GA, US -

International Classification:G05B 19/418

G06F 9/46 -

US Classification:705008000

-

Abstract:The present invention relates to application processing and decisioning systems and processes. One embodiment of the invention includes a method for automating decisioning for a credit request associated with an applicant. The method includes providing a user computer interface adapted to receive information associated with an applicant, and further adapted to display and receive information associated with at least one decision rule. The method also includes receiving information associated with an applicant through the user computer interface; receiving information associated with the applicant from at least one data source; and receiving a selection of information associated with a plurality of decision rules through the user computer interface. Furthermore, the method includes receiving a selection of rule flow information associated with the plurality of decision rules through the user computer interface; generating a plurality of decision rules based at least in part on the information associated with the applicant, based at least in part on the information associated with the applicant from at least one data source, and based at least in part on the selection of information associated with a plurality of decision rules, wherein an outcome associated with the at least one decision rule can be obtained; and based in part on at least the rule flow information, displaying at least a portion of the plurality of decision rules through the user computer interface.

-

Application Processing And Decision Systems And Processes

view source -

US Patent:20090048999, Feb 19, 2009

-

Filed:Oct 24, 2008

-

Appl. No.:12/257453

-

Inventors:Sandeep Gupta - Alpharetta GA, US

Christian Hall - Canton GA, US

James Reid - Alpharetta GA, US

Shen Lu - Duluth GA, US

Dennis Horton - Bufford GA, US

Lee Grice - Cumming GA, US

Thresa Dixon - Canton GA, US

Scott Garten - Canton GA, US

Sudhakar Reddy - Suwanee GA, US -

International Classification:G06N 5/04

G06Q 40/00 -

US Classification:706 47, 705 38

-

Abstract:The present invention relates to application processing and decisioning systems and processes. One embodiment of the invention includes a method for automating decisioning for a credit request associated with an applicant. The method includes providing a user computer interface adapted to receive information associated with an applicant, and further adapted to display and receive information associated with at least one decision rule. The method also includes receiving information associated with an applicant through the user computer interface; receiving information associated with the applicant from at least one data source; and receiving a selection of information associated with a plurality of decision rules through the user computer interface. Furthermore, the method includes receiving a selection of rule flow information associated with the plurality of decision rules through the user computer interface; generating a plurality of decision rules based at least in part on the information associated with the applicant, based at least in part on the information associated with the applicant from at least one data source, and based at least in part on the selection of information associated with a plurality of decision rules, wherein an outcome associated with the at least one decision rule can be obtained; and based in part on at least the rule flow information, displaying at least a portion of the plurality of decision rules through the user computer interface.

-

Detecting Synthetic Online Entities Facilitated By Primary Entities

view source -

US Patent:20220368704, Nov 17, 2022

-

Filed:Jul 22, 2022

-

Appl. No.:17/814451

-

Inventors:- Atlanta GA, US

Rakesh PATEL - Smyma GA, US

John MULLINAX - Cumming GA, US

Troy COLE - Moseley VA, US

Julio FARACH - Atlanta GA, US

Lee GRICE - Auburn AL, US

Patrick WADKINS - Dunwoody GA, US

Erik STRONG - Doraville GA, US

Cordell BOYNES - Lawrenceville FA, US -

International Classification:H04L 9/40

G06F 16/23

G06F 21/62

G06Q 20/40

G06Q 40/02 -

Abstract:In some aspects, a computing system can generate entity links between a primary entity object identifying a primary entity for multiple accounts and secondary entity objects identifying secondary entities from the accounts. The computing system can determine a rate at which secondary users change on the accounts. The computing system can update, based on the determined rate, the primary entity object to include a fraud-facilitation flag. The computing system can also service a query from a client system regarding a presence of a fraud warning for a target consumer associated with a consumer system that accesses a service provided with the client system. For instance, the computing system can generate a fraud warning based on the target consumer being identified in a secondary entity object associated with the primary entity object having the fraud-facilitation flag. The computing system can transmit the fraud warning to the client system.

-

Detecting Synthetic Online Entities Facilitated By Primary Entities

view source -

US Patent:20200145436, May 7, 2020

-

Filed:Jun 29, 2018

-

Appl. No.:16/623699

-

Inventors:- Atlanta GA, US

Rakesh PATEL - Smyrna GA, US

John MULLINAX - Cumming GA, US

Troy COLE - Moseley VA, US

Julio FARACH - Atlanta GA, US

Lee GRICE - Auburn AL, US

Patrick WADKINS - Dunwoody GA, US

Erik STRONG - Doraville GA, US

Cordell BOYNES - Lawrenceville GA, US -

International Classification:H04L 29/06

G06F 21/62

G06F 16/23

G06Q 20/40

G06Q 40/02 -

Abstract:In some aspects, a computing system can generate entity links between a primary entity object identifying a primary entity for multiple accounts and secondary entity objects identifying secondary entities from the accounts. The computing system can determine a rate at which secondary users change on the accounts. The computing system can update, based on the determined rate, the primary entity object to include a fraud-facilitation flag. The computing system can also service a query from a client system regarding a presence of a fraud warning for a target consumer associated with a consumer system that accesses a service provided with the client system. For instance, the computing system can generate a fraud warning based on the target consumer being identified in a secondary entity object associated with the primary entity object having the fraud-facilitation flag. The computing system can transmit the fraud warning to the client system.

-

Software Development Platform For Testing And Modifying Decision Algorithms

view source -

US Patent:20180189680, Jul 5, 2018

-

Filed:Feb 22, 2018

-

Appl. No.:15/903001

-

Inventors:- Atlanta GA, US

Christian Hall - Canton GA, US

James Reid - Alpharetta GA, US

Shen Lu - Duluth GA, US

Dennis Horton - Buford GA, US

Lee Grice - Cumming GA, US

Thresa Dixon - Canton GA, US

Scott Garten - Canton GA, US

Sudhakar Reddy - Suwanee GA, US -

International Classification:G06N 99/00

G06Q 40/02

G06Q 20/10

G06Q 40/00 -

Abstract:This disclosure involves development and deployment platforms for decision algorithms. For example, a computing system provides software development interface to a client device. The system sets, based on an input from the client device via the interface, a decision engine to a test mode that causes the decision engine to operate on test data stored in a first database and that prevents the decision engine from applying operations from the client device to production data stored in a second database. The system also configures the decision engine in the test mode to execute a different decision algorithms on the test data. The system also sets, based on another input via the interface, the decision engine to a deployment mode that causes the decision engine to operate on the production data. The system configures the decision engine in the deployment mode to execute one or more of the tested decision algorithms.

Myspace

Youtube

Lee Grice

view source

Lee Grice

view source

Lee Grice

view source

Lee Grice

view source

Lee Grice

view source

Lee Grice

view source

Lee Grice

view sourceClassmates

Lee Grice

view sourceSchools:

George Westinghouse Vo-Tech High School Brooklyn NY 1976-1980

Community:

Joyce Reeves

Slater-Marietta High Scho...

view sourceGraduates:

Rosa Lee Grice (1954-1958),

Ted Takacy (1960-1964),

Carolyn Foster (1959-1963),

Max Looper (1957-1961),

Samantha Hunt (1983-1987)

Ted Takacy (1960-1964),

Carolyn Foster (1959-1963),

Max Looper (1957-1961),

Samantha Hunt (1983-1987)

Googleplus

Lee Grice

Lived:

Cumming, GA

Auburn, AL

Tucker, GA

Auburn, AL

Tucker, GA

Education:

Auburn University - Computer Engineering

Lee Grice

Lee Grice

Lee Grice

Lee Grice

Flickr

Get Report for Lee W Grice from Auburn, AL, age ~60